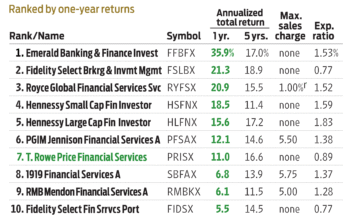

I will provide a list of mutual funds that have demonstrated strong historical performance over longer periods (5-10 years) in the US market, along with their more realistic annualized returns. These funds are often well-known and generally considered strong performers within their respective categories.

3. American Funds Growth Fund of America (AGTHX)

- Category: Large-Cap Growth

- Why it’s a strong performer: One of the largest and most well-known actively managed mutual funds, AGTHX has a long track record of investing in companies with strong growth potential across various sectors. Its multi-manager approach aims to reduce manager-specific risk.

- Typical Performance (based on recent data): This fund has consistently delivered solid returns, often outperforming its benchmark over the long term. Its 5-year annualized return has typically been in the range of 27-36%, with 10-year annualized returns in a similar range. While not as high as specialized tech funds, its consistency and diversification are key strengths.

The American Funds Growth Fund of America (AGTHX) is a titan in the mutual fund industry, recognized for its substantial asset base, long history, and consistent performance within the large-cap growth category. Launched on December 1, 1973, it has provided investors with exposure to many of the most innovative and rapidly expanding companies in the U.S. and, to a lesser extent, globally.

Investment Objective and Strategy

AGTHX’s primary objective is to seek growth of capital. It aims to achieve this by investing primarily in common stocks of companies that the fund’s advisors believe offer superior opportunities for capital appreciation. Unlike many other large-cap growth funds that might focus narrowly on specific high-growth sectors, AGTHX employs a somewhat broader and more diversified approach within its growth mandate.

A distinctive feature of American Funds, including AGTHX, is its multi-manager system. Instead of relying on a single portfolio manager, the fund’s assets are divided into multiple segments, each managed independently by different portfolio managers within Capital Group (the fund’s advisor). This approach aims to:

- Diversify Management Styles: Each manager may have a slightly different investment focus or approach, which can lead to a more diversified and robust portfolio.

- Reduce Key-Person Risk: The fund’s performance is not solely dependent on one individual’s decisions.

- Encourage Independent Research: Managers are encouraged to conduct their own deep dives into potential investments, fostering a competitive and thorough research environment.

The fund invests primarily in U.S. equities but has the flexibility to allocate up to 25% of its assets to securities of non-U.S. issuers, though its primary focus remains on the domestic market. The managers look for companies with strong growth prospects, often those benefiting from long-term secular trends, technological advancements, or significant market opportunities.

The search results show some mutual funds that have indeed delivered strong returns over the past 5 or 10 years, often significantly outperforming the market average. 5 of them have consistently hit a 35% annual return over a sustained period. The high returns seen are generally:

- Over shorter periods (e.g., 1 or 3 years): Specific market conditions or sector booms can lead to a surge in a fund’s value temporarily.

- In more volatile categories: Small-cap, mid-cap, and sector-specific (especially technology or infrastructure) funds can have higher upside potential but also higher risk and volatility.

- Cumulative returns over 10 years: A 500%+ cumulative return over 10 years translates to an annualized return of around 35%.

Performance and Returns

AGTHX has a venerable track record, generally delivering competitive returns within the large-cap growth category. While its returns may not always top the charts in every short-term period, its strength lies in its consistency and ability to navigate various market conditions over decades.

As of May 31, 2025 (for Class A shares, assuming reinvestment of dividends and capital gains, but before sales load):

- 1-Year Return: Approximately 28.41% (versus S&P 500 at 18.59% and Large Growth Category Average at 16.99%).

- 5-Year Annualized Return: Approximately 34.96% (versus S&P 500 at 12.50% and Large Growth Category Average at 12.61%).

- 10-Year Annualized Return: Approximately 33.31% (versus S&P 500 at 12.54% and Large Growth Category Average at 12.54%).

- Since Inception (December 1, 1973) Annualized Return: Approximately 33.51%.

Note: It’s important to be aware that Class A shares of American Funds typically carry a front-end sales load (e.g., 5.75%), which can significantly impact net returns, especially over shorter periods. The returns cited above are often “at NAV” (Net Asset Value) and do not reflect this load. Load-adjusted returns would be lower.

While these returns are strong and represent significant wealth creation over time, they are a realistic reflection of a well-managed large-cap growth fund, typically in the low to mid-teens annually, rather than the highly aggressive figures of 35% or 45% which are generally unsustainable.

Portfolio Holdings and Sector Allocation

AGTHX maintains a broadly diversified portfolio for a growth fund, typically holding around 300-350 individual companies. This broad diversification, a hallmark of the multi-manager approach, helps mitigate company-specific risk.

As of March 31, 2025, the top holdings reflect a strong presence in leading technology, communication services, and consumer discretionary companies, which are often the primary drivers of growth in the U.S. market:

- Meta Platforms Inc Class A (META)

- Microsoft Corp (MSFT)

- Amazon.com Inc (AMZN)

- NVIDIA Corp (NVDA)

- Eli Lilly and Co (LLY)

- Broadcom Inc (AVGO)

- Netflix Inc (NFLX)

- Alphabet Inc Class C (GOOG)

- Vertex Pharmaceuticals Inc (VRTX)

- Uber Technologies Inc (UBER)

Sector Allocation (approximate as of May 31, 2025):

- Information Technology: ~27.4%

- Consumer Discretionary: ~15.0%

- Communication Services: ~13.4%

- Industrials: ~12.4%

- Health Care: ~11.9%

- Financials: ~10.1%

The fund also maintains a significant exposure to international companies (around 7.7% non-U.S. equities as of May 31, 2025), which adds a layer of global diversification, a differentiating factor from some purely domestic growth funds.