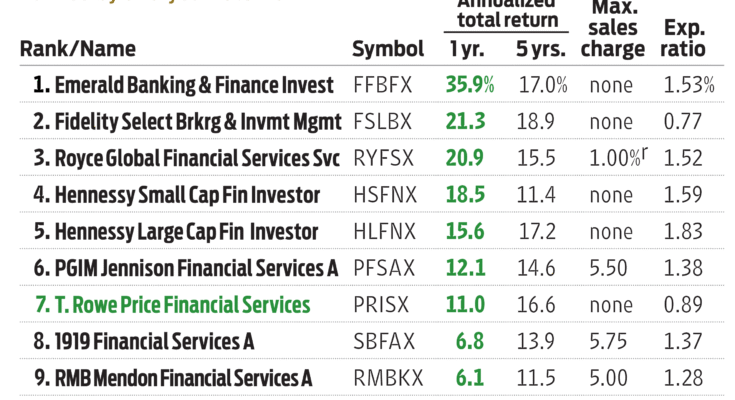

5. T. Rowe Price Financial Services Fund (PRISX)

- Category: Sector Equity (Financial Services)

- Why it’s a strong performer: While often overshadowed by tech, the financial services sector has periods of robust growth. This fund invests in companies across the financial industry, including banks, investment firms, and insurance companies.

- Typical Performance (based on recent data): This fund has shown strong 5-year annualized returns, sometimes exceeding 38%, particularly as interest rates and economic conditions favor financial institutions. Like other sector funds, its performance can be cyclical and tied to the health of the specific industry.

The T. Rowe Price Financial Services Fund (PRISX) is an actively managed mutual fund that offers investors a focused exposure to companies within the financial services industry. Launched on September 30, 1996, this fund provides a specialized investment vehicle for those who believe in the long-term prospects of banks, insurance companies, investment firms, and other related businesses.

Investment Objective and Strategy

The primary investment objective of PRISX is to seek long-term growth of capital and a modest level of income. To achieve this, the fund normally invests at least 80% of its net assets in the common stocks of companies operating in the financial services industry. This deep focus on a single sector makes PRISX a non-diversified fund, meaning its performance is highly correlated with the health and trends of the financial sector itself.

The fund’s management team, currently led by Matt J. Snowling (who has managed the fund since July 2021) and Gregory Locraft (who joined as a manager in September 2024), employs a fundamental, bottom-up analysis to identify high-quality companies with strong appreciation prospects. They look for businesses within the financial sector that demonstrate:

- Strong Financial Health: Sound balance sheets, profitability, and efficient capital allocation.

- Attractive Business Niches: Companies with competitive advantages and strong market positions.

- Capable Management: Experienced leadership teams with a clear strategic vision.

- Growth Potential: Businesses with the ability to increase revenues, earnings, and cash flow consistently.

The fund can invest across various sub-segments of the financial services industry, including:

- Regional and money-center banks

- Insurance companies (life, property & casualty)

- Brokerage and investment management firms

- Specialty finance companies

- Real estate companies (e.g., REITs, real estate services)

- Financial technology (FinTech) companies that derive substantial revenues from financial services.

Performance and Volatility

PRISX’s performance is inherently tied to the cyclical nature of the financial services industry. This sector is particularly sensitive to changes in interest rates, economic growth, regulatory environments, and consumer spending. As a result, while the fund can achieve strong returns during periods of economic expansion and rising interest rates, it can also experience significant volatility and drawdowns during economic contractions or financial crises.

As of recent data (May 31, 2025):

- 1-Year Return: Approximately 24.58% (outperforming its Morningstar Financial category average).

- 3-Year Annualized Return: Approximately 18.51% (significantly outperforming its category average).

- 5-Year Annualized Return: Approximately 19.79% (significantly outperforming its category average).

- 10-Year Annualized Return: Approximately 11.86% (outperforming its category average).

- Since Inception (September 30, 1996) Annualized Return: Approximately 10.46%.

These returns demonstrate that PRISX has historically been a strong performer within its specialized category, often outpacing its peers and sometimes even the broader market over certain multi-year periods. However, it’s crucial to look at yearly returns for a better understanding of its cyclicality. For example, some annual returns have been in the high 20s or even 30s (e.g., 37.81% in 2021, 29.73% in 2019), but also negative in other years.

Top Holdings and Concentration

As a sector fund, PRISX’s portfolio is concentrated in a relatively smaller number of companies compared to a broad-market fund, typically holding around 90-100 securities. Its top holdings reflect a blend of major banks, payment processors, and diversified financial services firms.

As of March 31, 2025, top holdings of PRISX typically include:

- Bank of America Corp (BAC)

- Mastercard Inc (MA)

- Visa Inc (V)

- Citigroup Inc (C)

- Charles Schwab Corp (SCHW)

- JPMorgan Chase & Co (JPM)

- Berkshire Hathaway Inc Class B (BRK.B) (which has significant financial holdings)

- Chubb Ltd (CB)

- Marsh & McLennan Companies Inc (MMC)

- Wells Fargo & Co (WFC)

These top 10 holdings can constitute over 35-40% of the total portfolio, indicating a high conviction approach to its best ideas within the sector. The fund’s primary geographic exposure is the United States (typically over 90%), with smaller allocations to non-U.S. financial companies.